Vicinity’s domestic print shows ongoing appetite for real estate

Vicinity Centres’ Australian dollar return provides another example of investor support for a wider range of corporate sectors – in this case, an oversubscribed book coming in for an issuer in the retail real estate sector as it seeks to move on from the pains of the pandemic. The issuer says domestic market conditions proved attractive for pricing and tenor.

Vicinity Centres’ fourth Australian dollar deal, which priced on 17 April, is its largest-ever domestic print having upsized to A$500 million (US$325.7 million) from A$300-A$400 million. The 10-year transaction priced at 170 basis points over swap via ANZ, Commonwealth Bank of Australia and Westpac Institutional Bank. According to KangaNews data, this is the largest Australian dollar REIT transaction since DWPF Finance priced a A$600 million dual-tranche deal on 27 July 2021.

Vicinity used bank debt for its funding needs in 2023. But with a funding task of approximately A$700 million for 2024 – including A$200 million of AMTNs set to mature in the last full week of April – Di Crossley, the issuer’s Melbourne-based general manager, treasury, says the borrower was eager to increase its portion of debt capital markets this year.

A domestic deal offered the best price point from the available funding sources, which include euros, Reg S US dollars and US private placements for Vicinity. “Credit spreads were a lot wider at the back end of 2023, especially for REITs,” Crossley tells KangaNews. “We observed a strong contraction over the first quarter of this year, however. As pricing came in for corporates, we had increased confidence that a deal would be possible.”

The domestic option also stood out on a duration basis, according to Crossley. Telstra’s 10-year print in February gave some indication of what could be achieved in the domestic market. Even so, Crossley says she was “blown away” by investors’ interest in 10-year tenor during the IOI process.

The deal was three times oversubscribed, with the book closing at A$1.5 billion. Altogether there were 50 accounts in the book, 84 per cent of which were investors Vicinity engaged with during its mandate process.

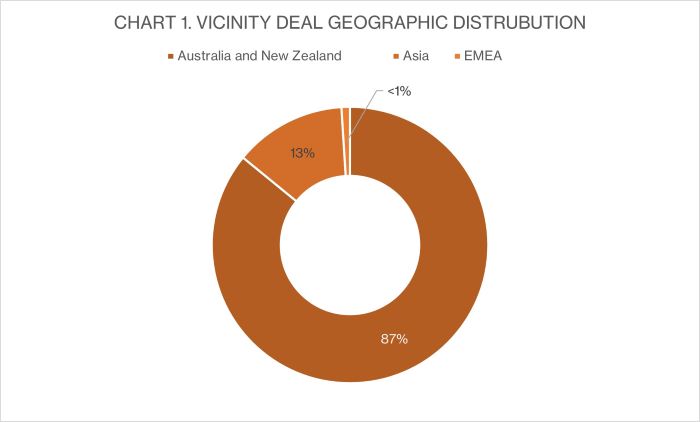

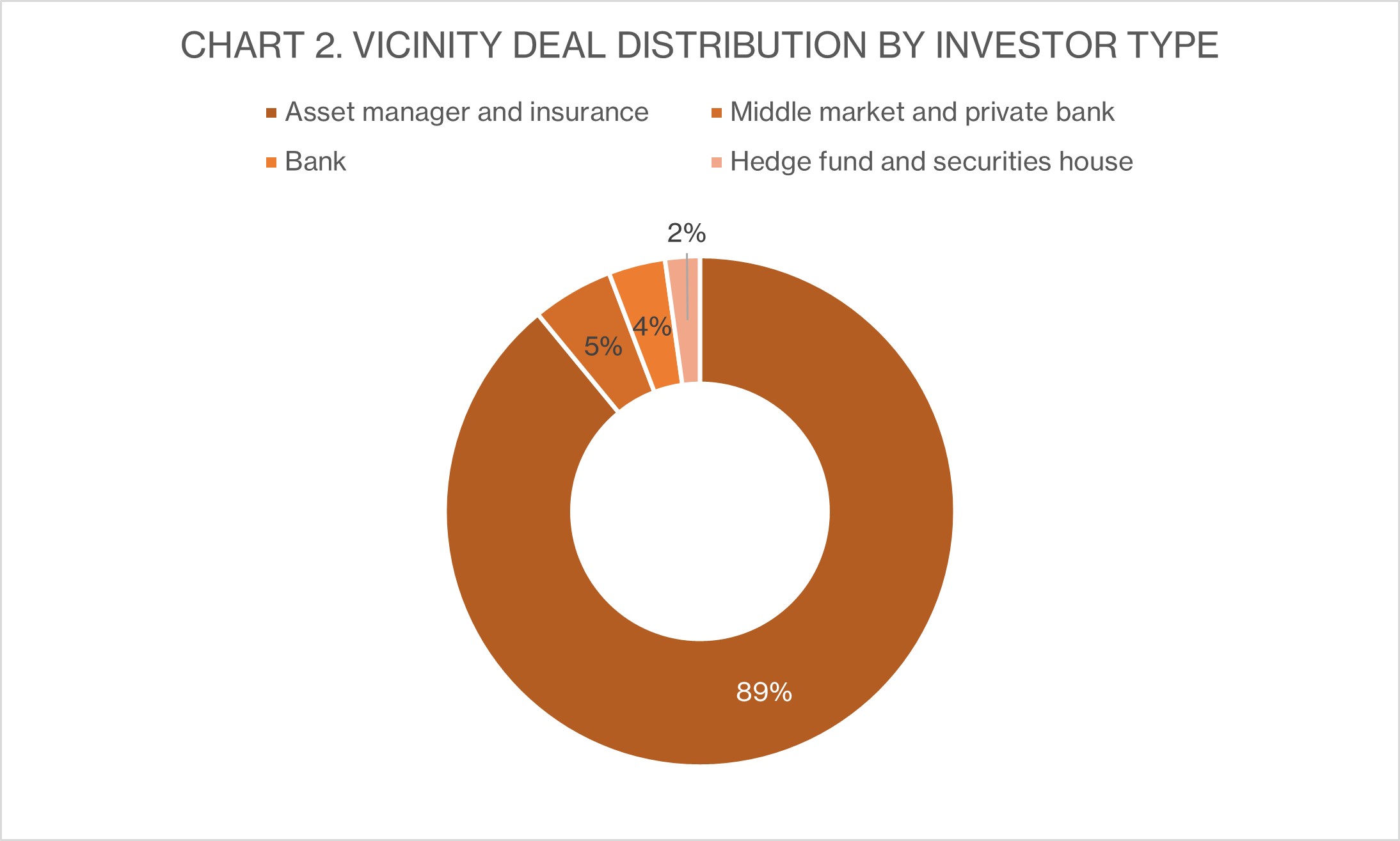

Just shy of 90 per cent of the book went to accounts in Australia and New Zealand (see chart 1). Crossley says this is “incredibly high” compared with what she has witnessed historically for bonds of the same tenor. Asset managers and insurers were to the fore (see chart 2).

Source: ANZ 18 April 2024

Source: ANZ 18 April 2024

SECTOR SHAPE

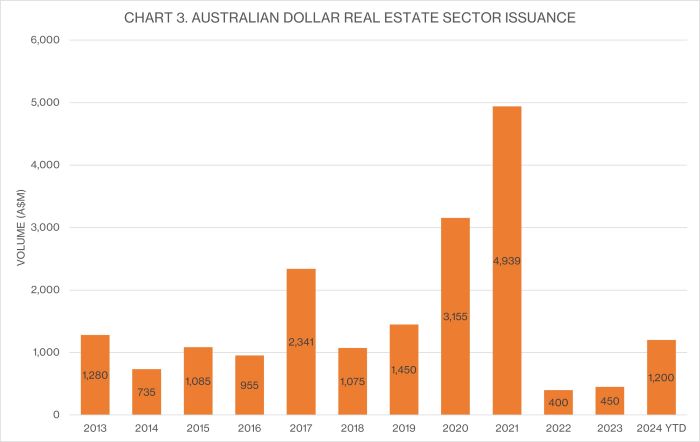

Like the rest of the economy, the real estate sector was severely hit by the impact of the pandemic. Public market activity has been subdued since 2021 (see chart 3) in part because of investor uncertainty.

Crossley says witnessing REIT deals from earlier this year – from names like Region Group and Stockland – as well as the spreads on offer provided Vicinity some assurance that investors are “happy to buy REITs again”. She notes, however, that those operating in the retail space are not subject to the same constraints that offices are still enduring.

“Retail REITs went through the valuation pain earlier in the pandemic than office spaces,” Crossley explains. “We have come out of that period now, which is contributing to the strong demand for our bonds.”

With Vicinity’s occupancy rate above 99 per cent, Crossley is optimistic about the sector’s health moving forward. “While some people might expect retail sales to remain on the weaker side in the near term, most are looking through the cycle,” she continues. “Stage three tax cuts will provide a boost to the retail sector and interest rate cuts are still on the agenda in the medium term.”

Source: KangaNews 22 April 2024

WOMEN IN CAPITAL MARKETS Yearbook 2023

KangaNews's annual yearbook amplifying female voices in the Australian capital market.