Australian dollar issuance records smashed in 2023

KangaNews data for calendar year 2023 confirm that a raft of sectors in the Australian dollar market experienced record new-issuance volume last year. The financial institution space in particular also delivered a notable uptick in issuance diversity, across unsecured and securitised deal formats. Meanwhile, issuance in New Zealand was consistent year-on-year.

Laurence Davison Head of Content KANGANEWS

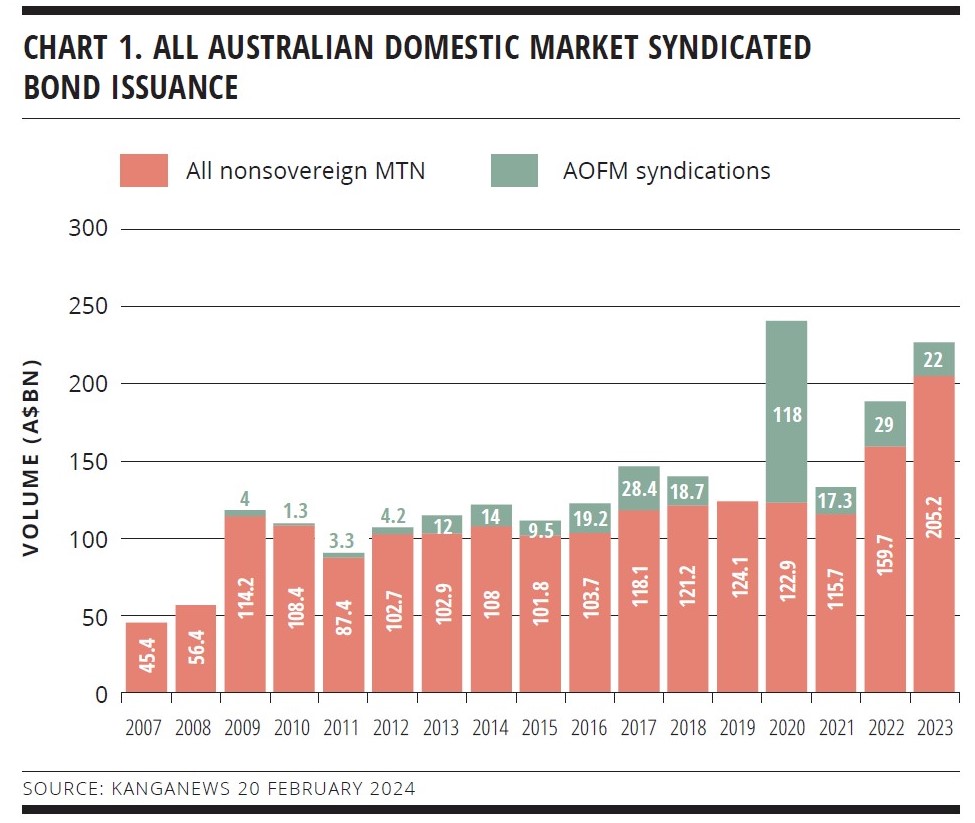

Excluding syndicated sovereign bond deals, the Australian dollar bond market has absorbed a consistent level of supply for much of the past decade and a half: a total of A$100-150 billion (US$65.3-98.1 billion) came to market in all but two years since 2009, with the outliers straying no further from the range than the A$87.4 billion from 2011 and A$159.7 billion in 2022.

Last year marked a step-change upward, as more than A$200 billion of combined supply from the local semi-government, global supranational, sovereign and agency (SSA), and unsecured bank and true corporate sectors came to market over the course of the year (see chart 1).

While the extraordinary pandemic era support funded by sovereign borrowing in 2020 prevents 2023 from taking the record for aggregate issuance, it was clearly a banner year for the Australian dollar market as a whole and for many individual sectors within it.

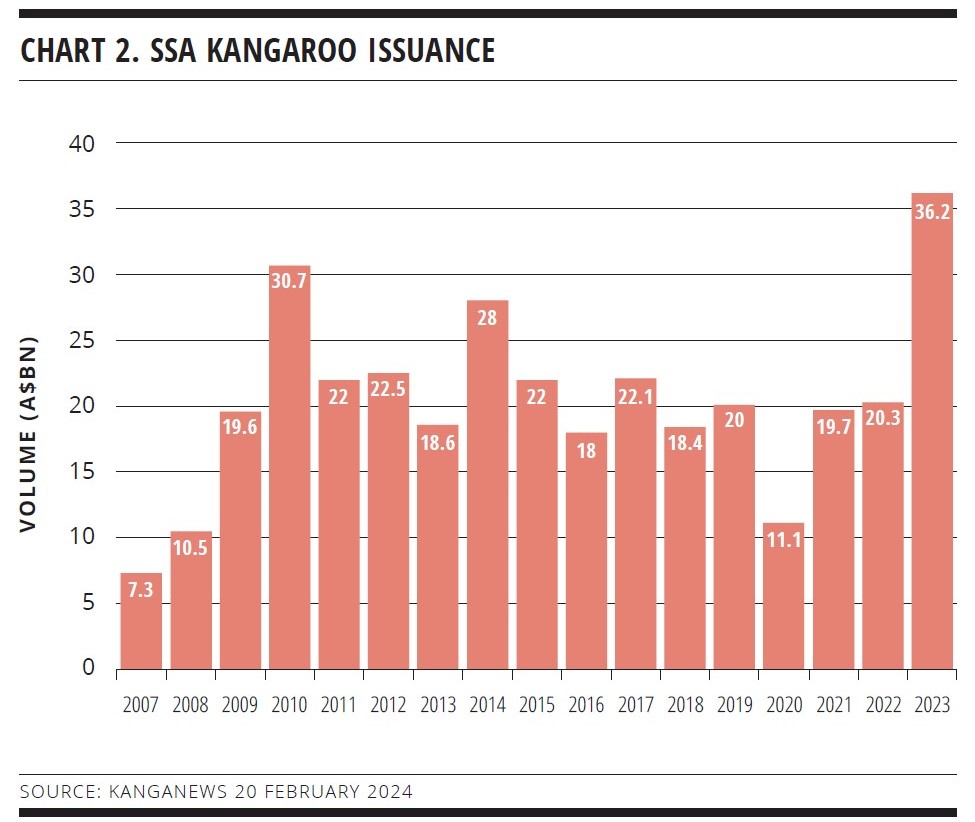

Two sectors drove the leap in issuance: SSAs and financial institutions. The Kangaroo market started hot in 2023 – though its January issuance record was broken once again in the new year (see feature) – and maintained a healthy pace throughout. In the end, A$36.2 billion of aggregate SSA supply priced in Australia in 2023, adding more than A$5 billion to a record that had stood for well over a decade (see chart 2).

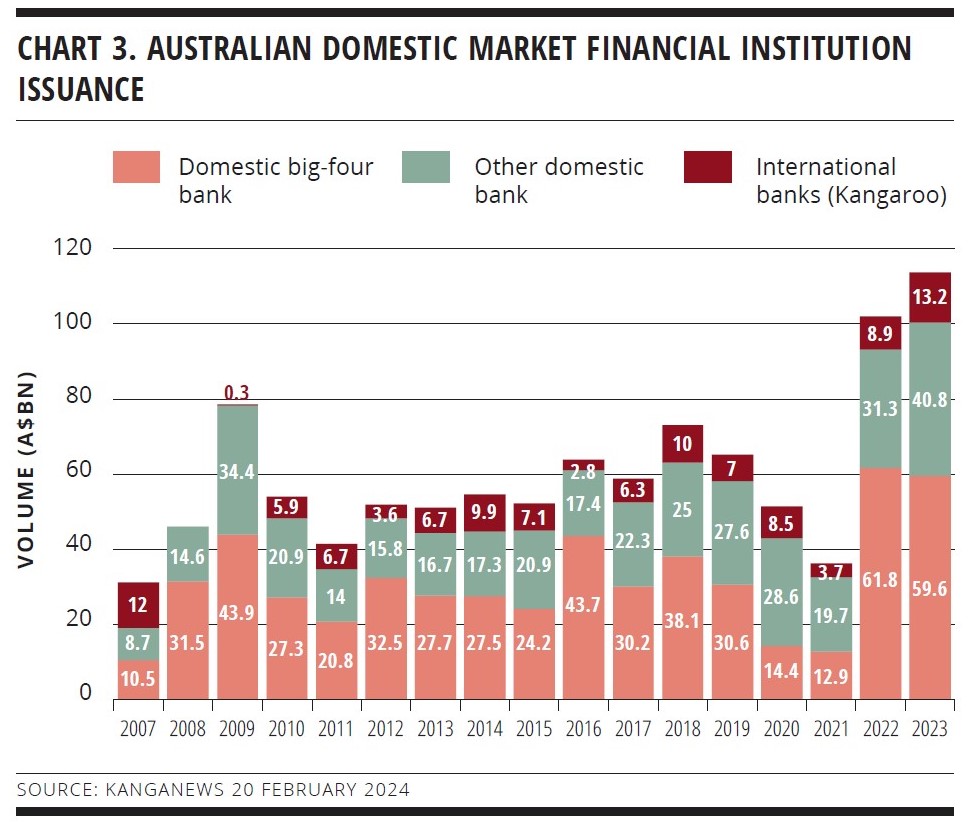

Financial institution supply also reached a record high last year, though in this case it was more a story of building on a leap forward taken in 2022 than breaking new ground. The A$113.6 billion priced added A$10 billion to the previous year’s total, which itself was more than A$20 billion more than a record that had stood since the days of sovereign-guaranteed bank issuance in 2009 (see chart 3).

Arguably, the real achievement of the financial institution market in 2023 was delivering even greater volume while also adding diversification to the supply side. Australian major-bank issuance actually fell very slightly, year-on-year – to A$59.6 billion from A$61.8 billion in 2022, albeit both figures were comfortably ahead of any previous year. However, this merely helped clear the way for a wider group of banks to access Australian dollar liquidity.

This volume breakthrough was maintained and even built upon in the early weeks of 2024 as a raft of domestic and global banks took advantage of Australian dollar demand. Even moving into February and on the back of more than A$20 billion of supply since the new year, prints from DBS Bank Australia Branch and Rabobank Australia suggested digestion was not yet an issue.

Issuance by non-big-four Australian banks – including local branches of international entities – increased by nearly one-third, to A$40.8 billion. True Kangaroo bank issuance grew by nearly 50 per cent, to A$13.2 billion.

Banks from a raft of jurisdictions accessed the Australian dollar debt market in 2023, either from the parent or via local branches.

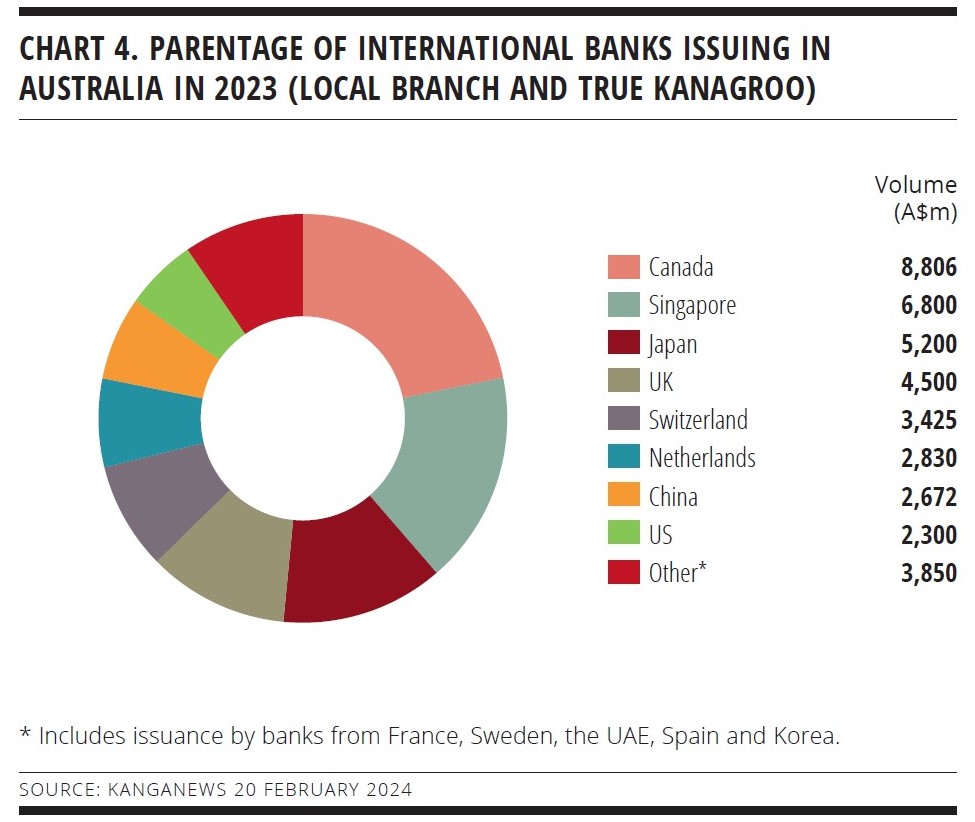

Canadian institutions provided the biggest single component of supply, at A$8.8 billion or around 20 per cent of the total, with Singaporean, Japanese, UK and Swiss banks rounding out the top five (see chart 4).

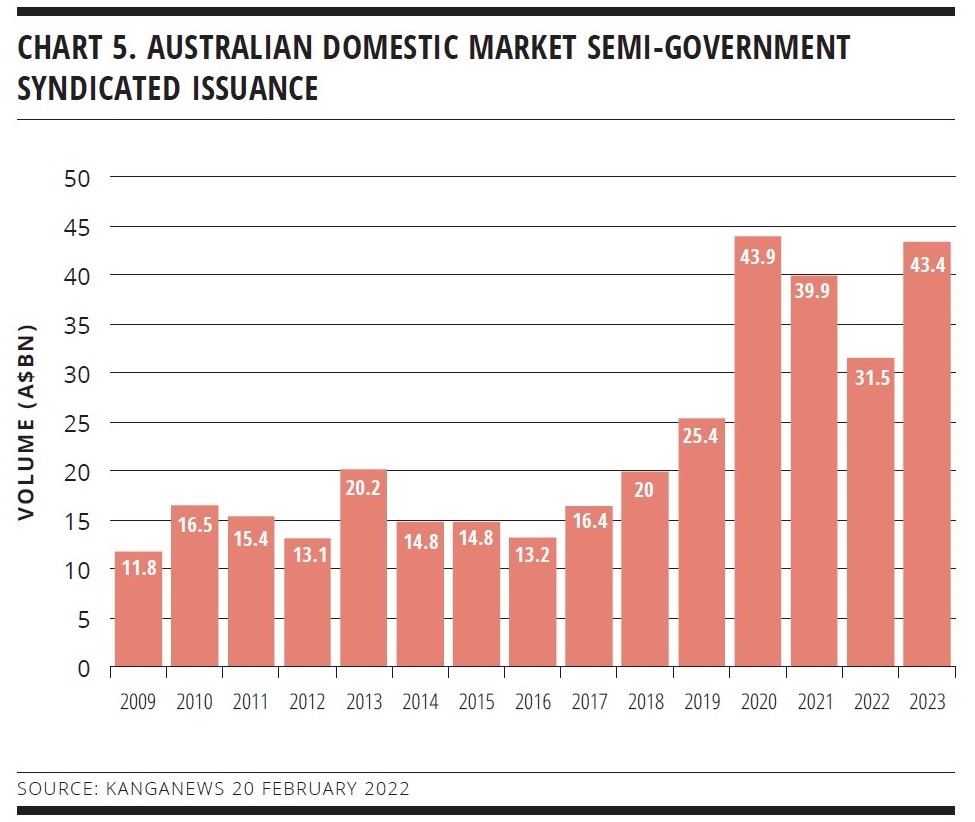

The issuance story in the Australian semi-government sector has been of funding tasks that have ceased accelerating but remain elevated after a pandemic-era leap. Syndicated supply in 2023 supports this story, as the A$43.4 billion issued falls short only of the A$43.9 billion priced in the first pandemic year of 2020 (see chart 5). The largest state government issuers have highlighted significantly enhanced turnover in their bonds as a positive product of increased volume on issue.

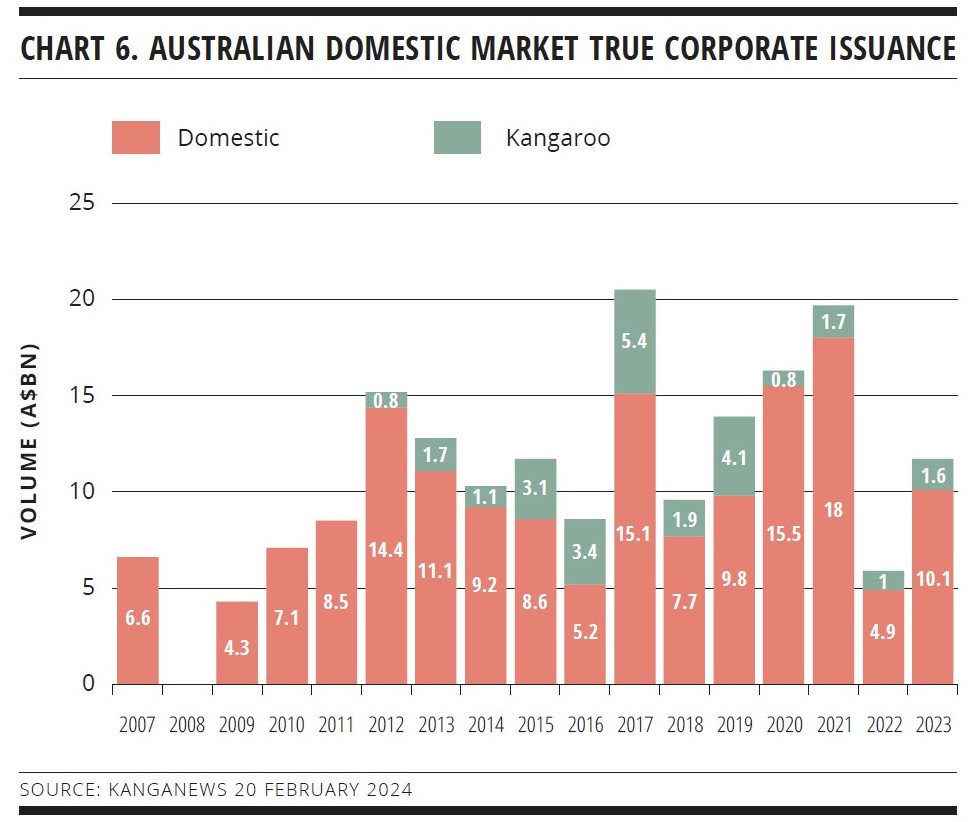

Other than the sovereign, the only Australian dollar issuer sector that did not produce record or near-record volume in 2023 was true corporates. The A$11.7 billion priced represents a rebound of sorts after a dismal 2022 but is still barely half the total that came to market in the most positive years for the Australian corporate market – 2017 and 2021 (see chart 6).

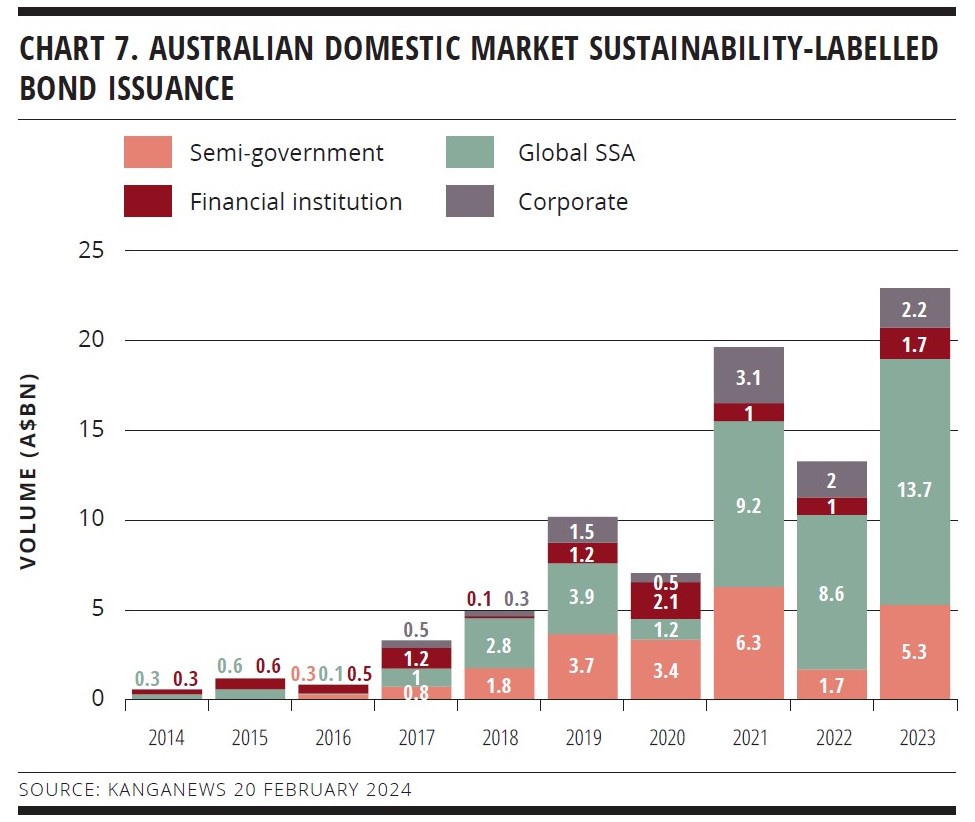

Another sector that is increasingly under the microscope is sustainability-labelled issuance. While 2023 was a record year for combined green, social and sustainability (GSS) and sustainability-linked bond issuance in Australia, the market still only represented just more than 10 per cent of total nonsovereign syndicated supply.

The overwhelming majority of issuance was GSS bonds from local state government and Kangaroo SSA issuers (see chart 7) – the latter representing more than one-third of total supply from the sector. About 15 per cent of semi-government syndicated issuance came to market in GSS format, while about 20 per cent of corporate deal flow and a negligible proportion of issuance by financial institutions had some form of sustainability label in 2023.

SECURITISATION SOARS

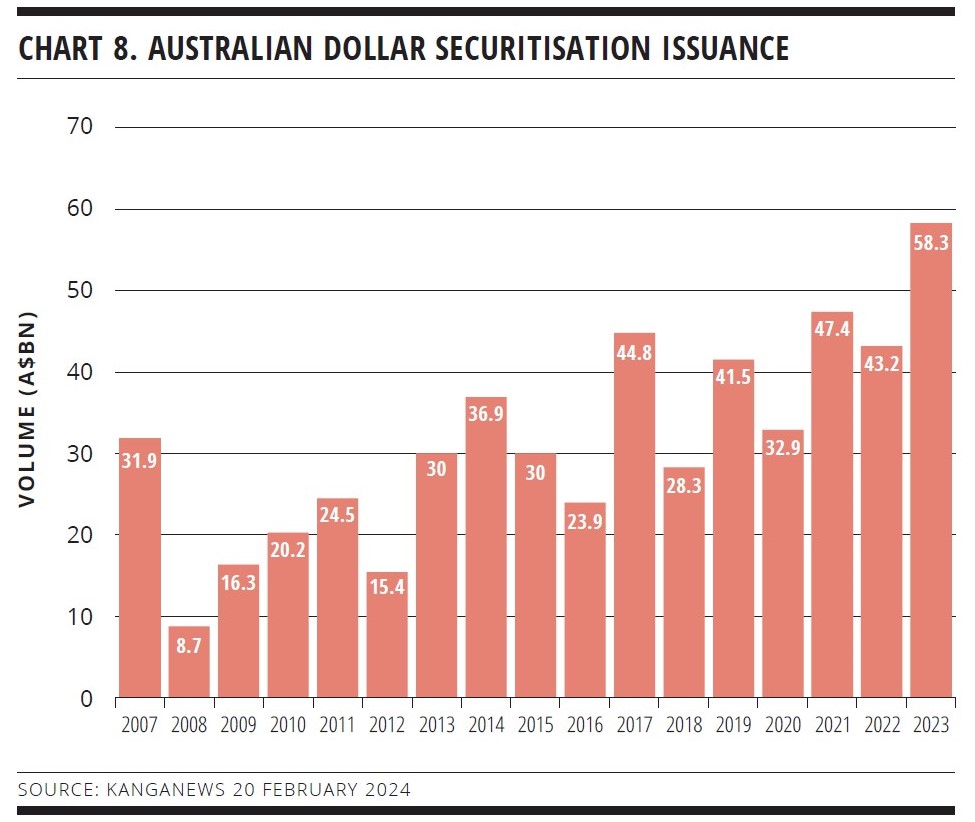

Moving into the structured-finance space, 2023 enjoyed a new record for total issuance with the A$58.3 billion surpassing the A$47.4 billion priced in 2021 and representing the first annual total of more than A$50 billion in the Australian securitisation market (see chart 8).

Again, positive deal conditions lingered into the new year. Despite typically being a relatively late starter, a raft of bank and nonbank residential mortgage-backed securities deals made for a busy start to 2024.

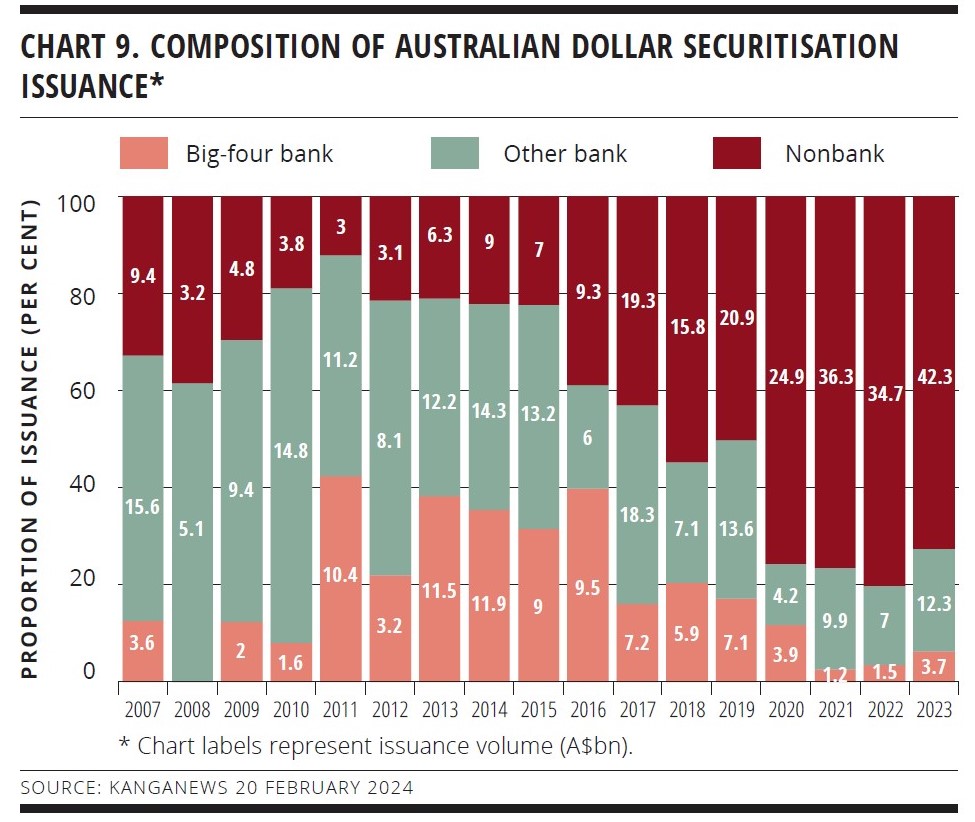

Like the unsecured financial institution bond market, securitisation supply was buoyed by issuance diversity in 2023. Bank issuers had a slight uptick in activity, the A$16 billion of such supply coming in as the highest level for this subsector since 2019 though still well short of pre-pandemic norms (see chart 9).

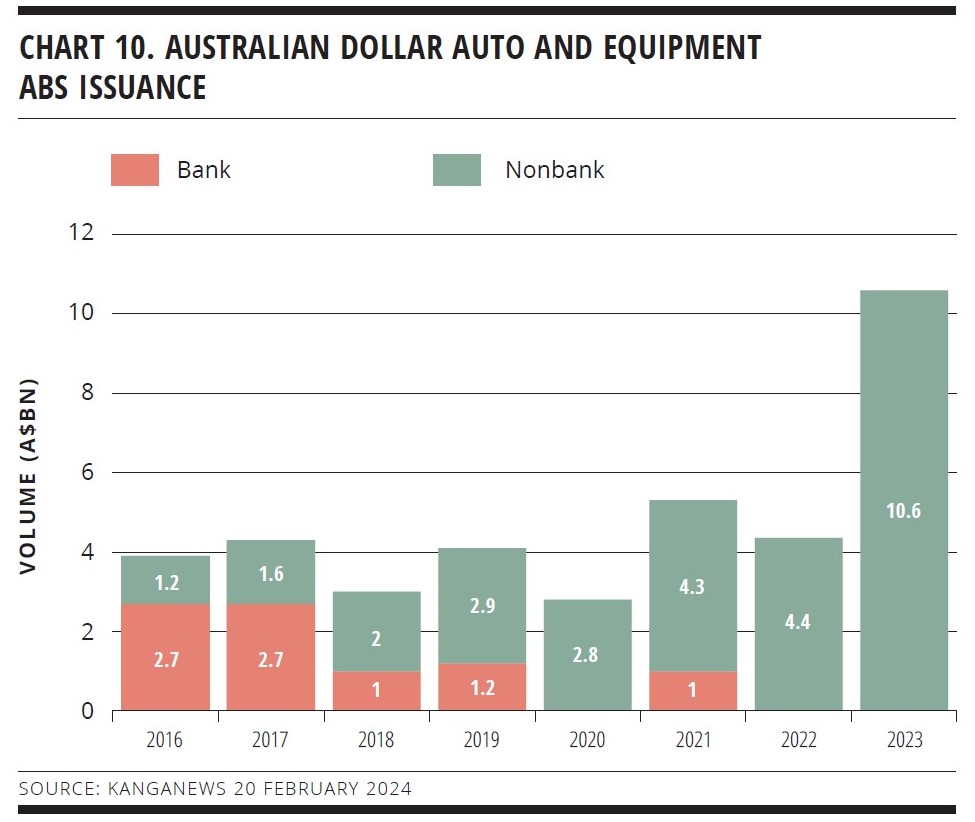

The real diversity story in 2023’s securitisation issuance was on the collateral side. The market saw breakthrough benchmark deals using SME loans as collateral, but the biggest growth area – by some distance – was auto-backed issuance. The A$10.6 billion of auto and equipment asset-backed securities priced in 2023 was comfortably a record (see chart 10) and accounted for nearly 20 per cent of total supply.

CONSISTENCY IN NEW ZEALAND

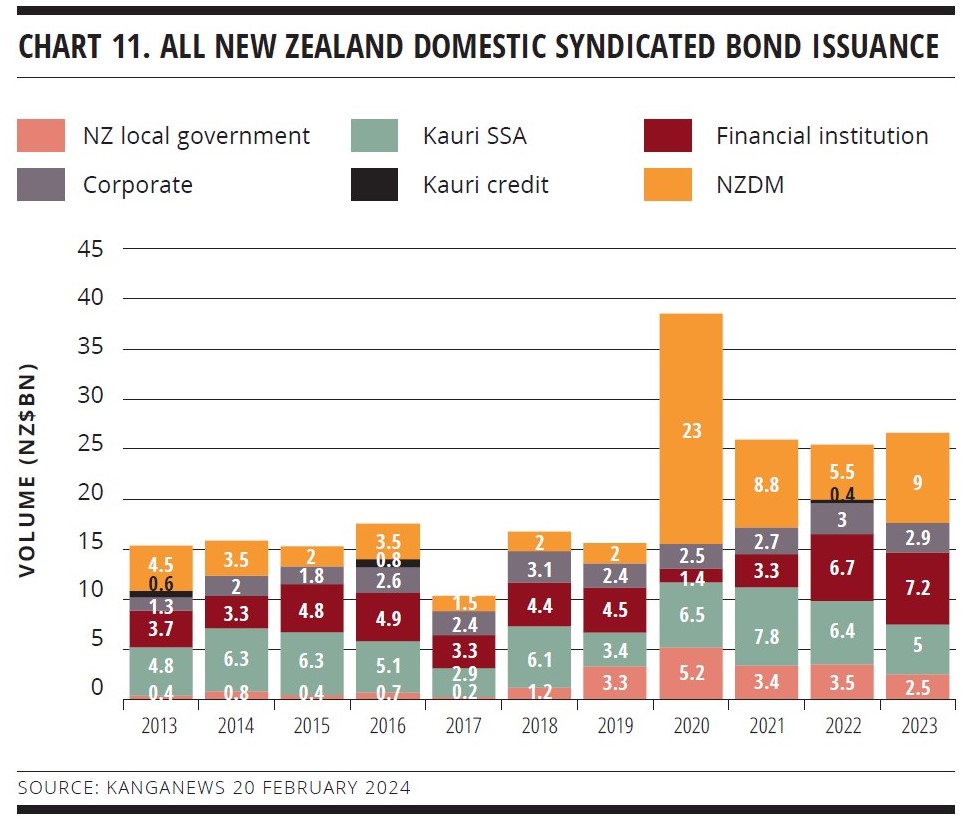

Deal flow in the New Zealand market, meanwhile, was more a story of consistency than significant growth. However, total issuance excluding sovereign syndications was the second-highest on record, the NZ$17.6 billion (US$10.8 billion) total surpassed only by the NZ$20 billion issued in 2022 (see chart 11).

As in Australia, bank issuance took another step forward – reaching NZ$7.2 billion or NZ$500 million more than the previous record, set the preceding year – while true corporate supply maintained a streak of eight years in which issuance has been in the NZ$2.4-3.1 billion range.

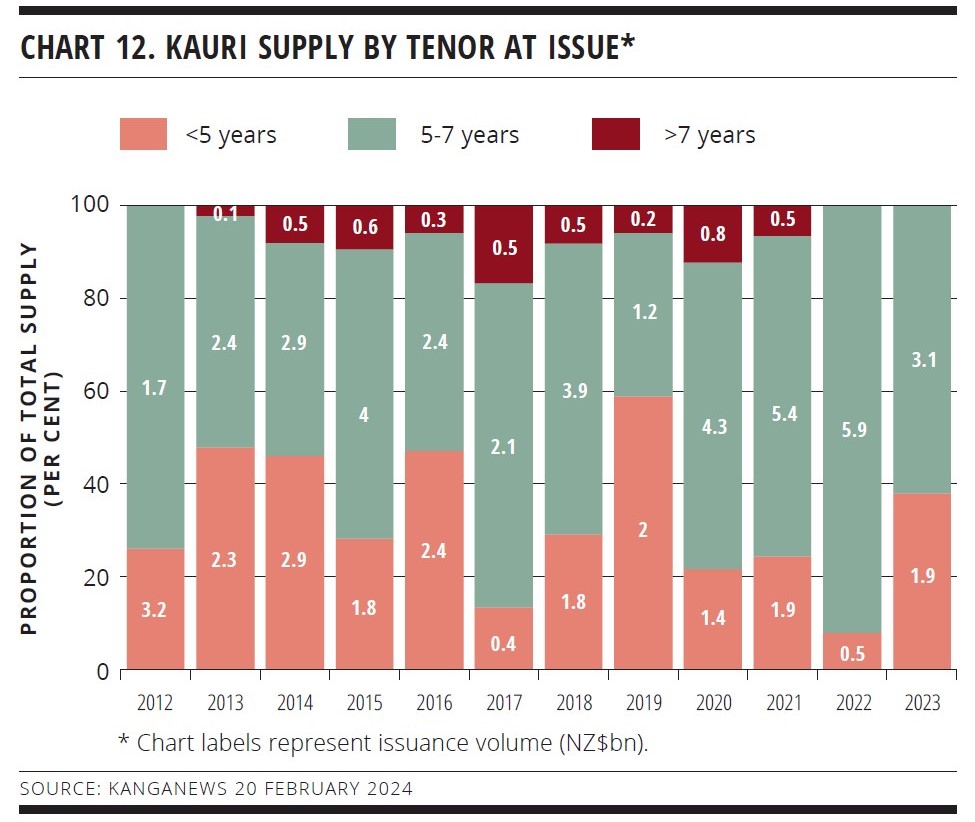

The only sector that took a notable step back in 2023 was the Kauri market. Uncertainty about the future status of SSA Kauri bonds in the regulatory liquid asset regime for local banks helped keep total issuance to NZ$5 billion – the lowest level since 2019 – while the deals that did come to market were also more focused on the short end than any year for the past five (see chart 12).

Even this outcome somewhat underplays the impact of the Reserve Bank of New Zealand’s liquidity policy review. NZ$1.6 billion of Kauri supply – all of it at five-year or longer tenor – came to market before the regulatory uncertainty kicked off in February while another NZ$500 million priced in December as the market started to develop greater confidence about the asset class’s prospects.

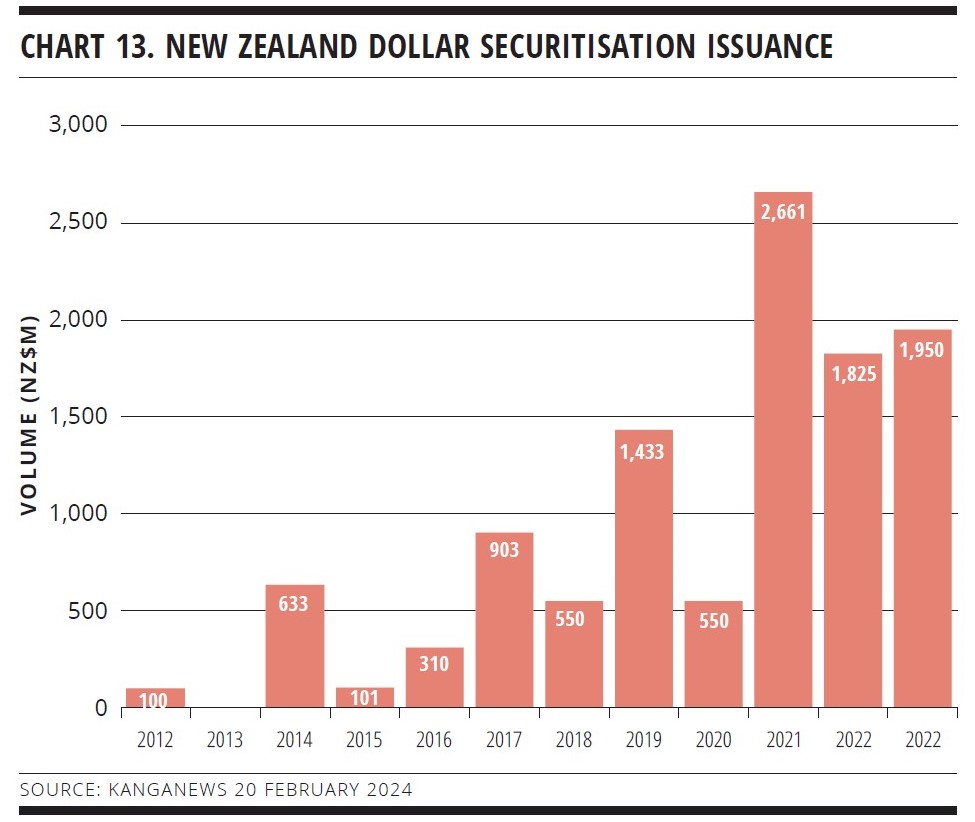

The New Zealand securitisation market, meanwhile, appears to have reached a new, higher plateau for new issuance over the past three years. Last year marked the third in a row in which at least NZ$1.8 billion of such supply came to market though only one year – 2021 – saw deal flow take the next step beyond NZ$2 billion (see chart 13).

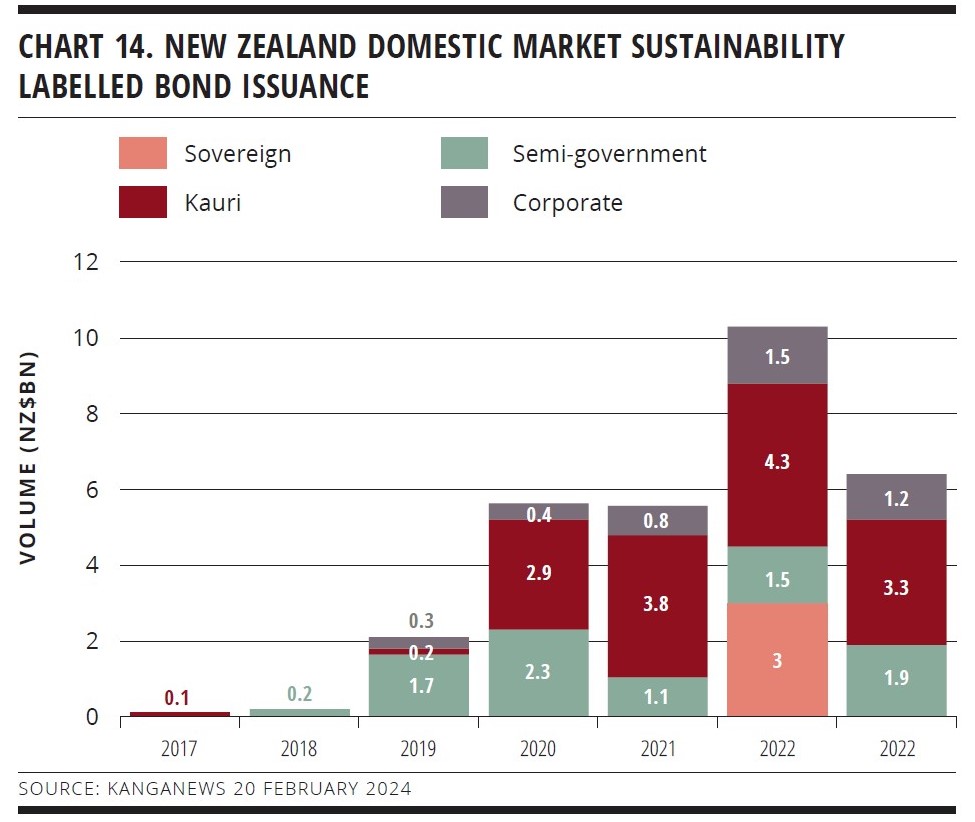

Sustainability-labelled supply took a step back in New Zealand in 2023, albeit the bulk of the gap can be attributed to the absence of a sovereign green-bond syndication. More than half the NZ$6.4 billion of total supply – all of it in GSS format – came from SSA issuers in the Kauri market (see chart 14).

HIGH-GRADE ISSUERS YEARBOOK 2023

The ultimate guide to Australian and New Zealand government-sector borrowers.

nonbank Yearbook 2023

KangaNews's eighth annual guide to the business and funding trends in Australia's nonbank financial-institution sector.

WOMEN IN CAPITAL MARKETS Yearbook 2023

KangaNews's annual yearbook amplifying female voices in the Australian capital market.

SSA Yearbook 2023

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.