Stay tuned for more Kangaroos, PSP promises

In late January, the Kangaroo market welcomed its latest new borrower: PSP Capital, the funding arm of Canadian-based pension investment manager PSP Investments. KangaNews catches up with Renaud de Jaham, managing director and treasurer at PSP Investments in Montreal, to discuss the debut transaction and its aspirations for future Australian dollar issuance.

How long has the Kangaroo market been on PSP Capital's radar?

A Kangaroo programme has been on our radar for several years and we have followed the market for some time, including fellow Canadian issuers such as Province of Québec and, more recently, CPPIB Capital.

Australian dollar funding is a natural fit for us. We are an investor in the Australian market and have assets in the currency, so it makes sense from a balance sheet perspective.

The consideration for not issuing until now has been the size of our funding programme. In recent years our assets under management have grown to the point where it now makes sense.

Does this suggest that the very conducive market conditions Australia has been enjoying at the start of 2024 were not a primary driver?

The decision to choose to establish a Kangaroo programme now was more PSP specific than it was market specific. Getting to this point has been a journey and something we have intended to do for some time; it was only a matter of waiting until we had the critical mass to issue frequently.

In saying this, prior to our deal – at the end of January – the Kangaroo market was performing well. We saw several transactions that were oversubscribed and we believed there was enough momentum to support an inaugural trade.

What is PSP’s overall annual funding requirement and what role do you hope the Australian dollar market will play going forward?

This financial year we have issued about C$5 billion (US$3.7 billion). The majority of this has been in Canadian dollars and our Kangaroo is our largest offshore transaction. We anticipate Australian dollars will become an important market for us as we invest in Australia and have liabilities there.

“Prior to our deal, the banks shared information that suggested indicative levels were slightly to the up side of the Canadian market, and in the end the deal cost us about 10 basis points more than what we could have issued at home. For us, this is appropriate: it is worth it to diversify the investor base.”

CPPIB is an obvious comparison for PSP. To what extent did its Kangaroo activity help your transaction?

CPPIB was a useful point of comparison and helped pave the way for our debut. There are many similarities between CPPIB and PSP, and CPPIB’s presence makes it easier for us to tell our story and for investors to understand the credit profile of PSP.

Does this suggest you have aspirations to build an Australian dollar curve over time?

We hope this is something we can develop over time. In general, we like to gravitate toward where demand is, so I expect most of our issuance will be benchmark three-, five-, seven- or 10-year deals. However, we are also willing to consider issuance in the long end – provided there is demand.

How many times per year do you aim to be in the Kangaroo market?

It will depend on the funding programme, and it is something we will need to judge year-by-year. However, if we sense there is appetite in the market to support another deal, and since Australian dollars is a good match for our balance sheet, we may come back with another benchmark transaction before the end of the calendar year – provided market conditions are supportive.

“Sometimes we issue in Canadian dollars and see international investors participating in a big way, whereas other times they are almost absent. It really depends. What I can say, though, is that this is the most balanced book I have seen for quite a while.”

Debut volume of A$1.5 billion (US$981 million) is substantial but not unprecedented in the Kangaroo market. What were your volume aspirations going into the trade?

Our original ambition was for a A$1 billion transaction and, given the performance of trades in the lead-up to ours, we were confident this would be achievable. Once we launched, demand was extremely strong so we decided to go ahead with an upsize.

What would you say are the main advantages of the Kangaroo market as a funding source?

The Kangaroo market is attractive for three reasons. The first I’ve mentioned several times: it is a good fit for our balance sheet. The second is that funding levels in Australian dollars are fairly competitive to the Canadian market and stable.

The third reason – and for me the most important one – is that it offers an opportunity to broaden PSP’s investor base for the long run.

For the ongoing health of our funding programme, we need a diversified investor base – and the best way for us to reach Australian investors and other institutional investors looking at Australian dollars was to develop a Kangaroo programme.

How did the cost of funding compare with what PSP could have issued elsewhere? What were the reference points?

The reference point is always the indicative level to Canadian dollars. Prior to our deal, the banks shared information that suggested indicative levels were slightly to the up side of the Canadian market, and in the end the deal cost us about 10 basis points more than what we could have issued at home. For us, this is appropriate: it is worth it to diversify the investor base. Otherwise, we also considered CPPIB’s new-issue price to the Australian asset-swap curve earlier in the month.

By contrast, during the period in January that we did the Kangaroo, indicative pricing in other potential currencies of issuance didn’t look as attractive.

Is there an upper bound or a point where the cost of Australian dollars outweighs the benefits?

There is no upper bound but we always look at all our options. Given the options we had in January, we felt a 10 basis point premium to issue in Australia and receive the benefits of diversification made a lot of sense, especially when most other markets would have been more expensive.

Domestic investors are often a primary target of international borrowers for the diversification value they provide. What was the domestic portion of the PSP book and is this something you hope to further develop over time?

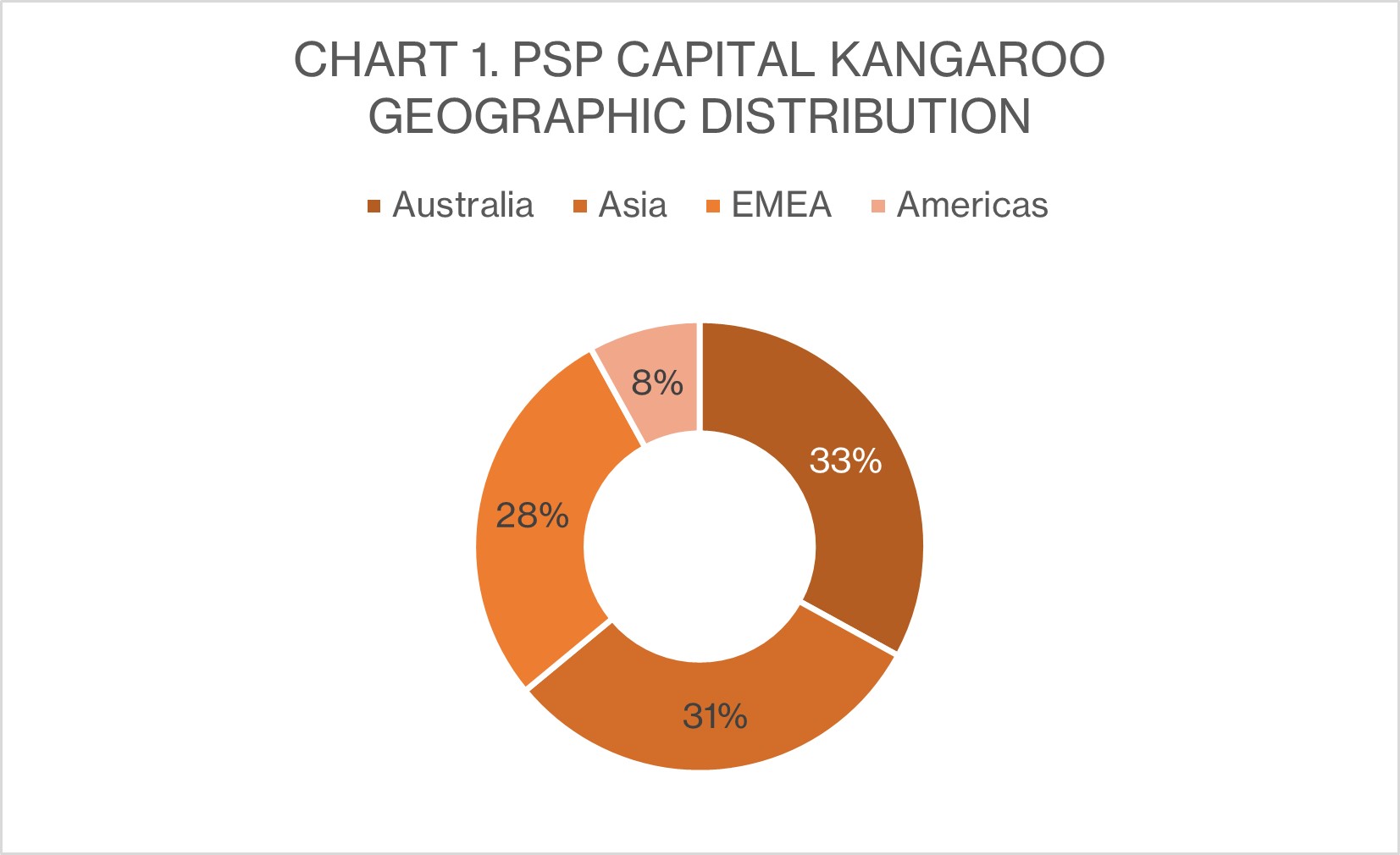

We were impressed with the diversification we received in the book. One-third of the bonds went to Australian investors and, generally speaking, the allocation was well balanced between Australia, Asia, Europe and the rest of the world (see chart 1).

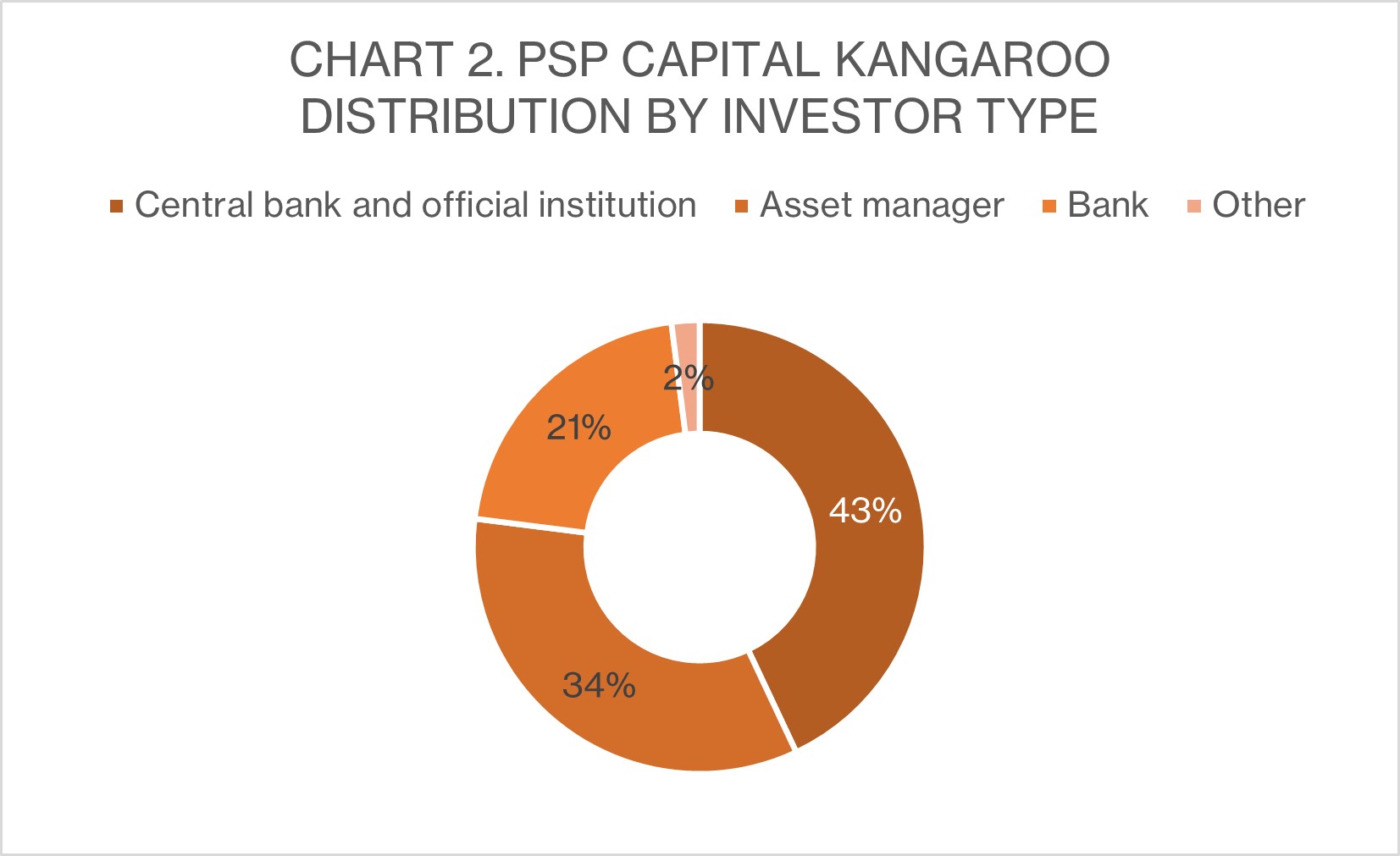

We were also satisfied with the types of investors in the book: there were official institutions, bank treasuries, real-money managers, asset managers and pension funds (see chart 2). Additionally, we are pleased with the number of orders.

Source: Nomura 1 February 2024

Source: Nomura 1 February 2024

Is this similar to what you see when you issue in other markets?

Again, it depends on the dynamics of markets at the time of issuance. Sometimes we issue in Canadian dollars and see international investors participating in a big way, whereas other times they are almost absent. It really depends. What I can say, though, is that this is the most balanced book I have seen for quite a while.

Is there anything else you would like to share with Australian market participants?

I would like to reiterate that this is the beginning of our journey. Our debut transaction has been a very good start. Over the next few years, I hope we can build credibility with the investor community in Australia and keep building the relationship. Stay tuned.

SSA Yearbook 2023

The annual guide to the world's most significant supranational, sovereign and agency sector issuers.